CBSE Sample Papers for Class 12 Accountancy Set 6 with Solutions

Students must start practicing the questions from CBSE Sample Papers for Class 12 Accountancy with Solutions Set 6 are designed as per the revised syllabus.

CBSE Sample Papers for Class 12 Accountancy Set 6 with Solutions

Time :3 hrs

Max. Marks: 80

Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Part-A has Accounting for Partnership Firms and Companies.

- Part-B has Analysis of Financial Statements.

- Questions Nos. 1 to 16 and 27 to 30 carries 1 mark each.

- Questions Nos. 17 to 20, 31 and 32 carries 3 marks each.

- Questions Nos. from 21, 22 and 33 carries 4 marks each

- Questions Nos. from 23 to 26 and 34 carries 6 marks each

- There is no overall choice. However, an internal choice has been provided in 7 questions of

one mark, 2 questions of three marks, 1 question of four marks and 2 questions of six marks.

Part A

(Accounting for Partnership Firms and Companies)

Question 1.

Tia, Pia and Sia are partners sharing profits equally. Tia drew regularly ₹ 2,000 in the beginning of every month for the six months ended 30th September, 2022. Calculate interest on Tia’s drawings @ 5% p.a.

(a) ₹ 100

(b) ₹ 600

(c) ₹ 175

(d) ₹ 350

Answer:

(c) Interest on Tia’s Drawings = Total Drawings x Rate of Interest / 100 x Average Period/12

= (2,000 x 6) x 5 / 100 x 3.5 / 12 = ₹ 175

Or

A, B and C are partners sharing profits in the ratio of 5: 3: 2. They have admitted Z into the partnership for 1/6 th share. Investment fluctuation fund appears in the balance sheet at ₹ 13,500 and Investment (cost) at ₹ 1,50,000. If the market value of investments is ₹ 1,45,000. investment fluctuation fund will be shown at

(a) ₹ 13,500

(c) ₹ 5,000

(b) ₹ 10,000

(d) ₹ 6,500

Answer:

(c) Difference between cost price and market value of investments is ₹ 5,000(1,50,000-1,45,000). Investment fluctuation fund will be shown at ₹ 5,000 in the balance sheet of new firm.

Question 2.

Ashish and Avnish are partners sharing profits in the ratio of 10: 2. Ankit is admitted and the new profit sharing ratio is now 10: 6: 4. At the date of admission, general reserve appears in the books at ₹ 48,000. Avnish’s share in the reserve will be

(a) ₹ 8,000

(b) ₹ 40,000

(c) ₹ 14,400

Answer:

(a) Avnish’s share in reserve =48,000 x 2/12 = ₹ 8,000

Or

With context to debit side of partners’ current account, pick the odd one out.

(a) Drawings

(b) Interest on drawings

(c) Salary

(d) None of these

Answer:

(c) Salary

Question 3.

X Limited purchased the assets from ‘ Y ‘ Limited for ₹ 16,20,000. ‘X’ Limited issued 10% debentures of ₹ 10 each at 10% discount against the payment. The number of debentures issued by ‘X ‘ Limited will be

(a) 16,200

(b) 18,000

(c) 1,80,000

(d) 1,62,000

Answer:

(c) Number of Debentures =\(\frac{16,20,000}{10-(10 \% \times 10)}=\frac{16,20,000}{9}\) = 1,80,000

Question 4.

(d) 1,62,000 ……….. shares confer voting rights on its holders.

(a) Equity

(b) Redeemable preference

(c) Participatory preference

(d) None of the above

Answer:

(a) Equity

Question 5.

XYZ Ltd. called first call money of ₹ 3 per share on its 50,000 shares. A shareholder holding 2,750 shares failed to pay the amount. How much amount will be due on first call?

(a) ₹ 1,41,750

(b) ₹ 1,57,000

(c) ₹ 1,50,000

(d) ₹ 1,47,750

Answer:

(c) Call money is made due with the whole amount. As per question, ₹ 1,50,000(50,000 x 3) will be made due.

Or

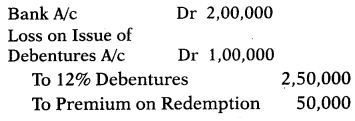

The following journal entry is appeared in chanda Ltd.

Debentures are issued at a discount of …………………

(a) 5%

(b) 10%

(c) 15%

(d) 20%

Answer:

(d) \(\frac{1,00,000-50,000}{2,50,000}\) x 100 = 20%

Question 6.

A, B and C are partners with capitals ₹ 1,00,000, ₹ 75,000 and ₹ 50,000 respectively. On C’s retirement, his share is acquired by A and B in ratio of 5: 3. Gaining ratio will be

(a) 3: 2

(b) 2: 2

(c) 5: 3

(d) None of these

Answer:

(c) On C’s retirement, his share is acquired by A and B in the ratio of 5: 3. Therefore, 5: 3 is the gaining ratio.

Question 7.

X, Y and Z are partners in a firm sharing profits in the ratio of 5: 3: 2. As per partnership deed, Z is to get a minimum amount of ₹ 1,000 as profit. Net profit for the year is ₹ 4,000. Calculate deficiency (if any) to Z.

(a) ₹ 75

(b) ₹ 200

(c) ₹ 150

(d) None of these

Answer:

Or

A and B are partners sharing profits in the ratio of 5: 1. C is admitted and the new profit sharing ratio is now 5: 3: 2. Upon admission, general reserve appears in the books at ₹ 48,000. B’s share in the reserve will be ………..

(a) ₹ 8,000

(b) ₹ 40,000

(c) ₹ 14,400

(d) None of the above

Direction Read the following hypothetical situation and answer Q. No. 8 and 9

Sita, Reeta and Geeta are partners in a firm sharing profits and losses in the ratio of 4: 3: 1. As per the terms of partnership deed, on the death of any partner, goodwill was to be valued at 50% of the net profits credited to that partner’s capital account during the last three completed years before her death. Sita died on 28th February, 2022. The profits for the last five years were 2017- ₹ 60,000, 2018 – ₹ 97,000,2019 – ₹ 1,05,000, 2020 – ₹ 30,000 and 2021 – ₹ 84,000.

On the date of Sita’s death, building was found undervalued by ₹ 80,000, which was to be considered. Calculate amount of Sita’s share of goodwill in the firm and complete the following journal entries. The new profit sharing ratio between Reeta and Geeta will be equal.

Answer:

(a) B’s share in reserve = 48,000 x 1/6 = ₹ 8,000

Question 8.

Geeta’s share in revaluation profit/loss will be ……….

(a) ₹ 40,000

(b) ₹ 30,000

(c) ₹ 10,000

(d) Nil

Answer:

(c) Geeta’s share in revaluation profit =80,000 x 1/8 = ₹ 10,000

Question 9.

Sita’s share of goodwill will be [1]

(a) ₹ 13,688

(b) ₹ 54,750

(c) ₹ 41,062

(d) Nil

Answer:

(b) Total of last three years profit = 1,05,000 + 30,000 + 84,000 = ₹ 2,19,000

Sita’s share in last three years profit = 2,19,000 x 4/8 = ₹ 1,09,500

Sita’s share of goodwill =1,09,500 x \(\frac{50}{100}\) = ₹ 54,750

Question 10.

Which of the following is not correct in relation to right of a partner? [1]

(i) Right to inspect the books of the firm

(ii) Right to take part in the affairs of the company

(iii) Right to share the profits/losses of the firm

(iv) Right to receive salary at the end of each month

Codes

(a) (i) and (ii)

(b) (i) and (iv)

(c) Only (iv)

(d) Only (i)

Answer:

(c) Only (iv)

Question 11.

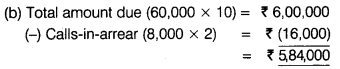

PQR Ltd. is registered with a capital of 1,00,000 equity shares of ₹ 10 each. 60,000 equity shares were offered for subscription to public. Applications were received for 60,000 shares. All calls were made and amount was duly received except final call of ₹ 2 on 8,000 shares. What will be the amount of share capital shown in the balance sheet? [1]

(a) ₹ 6,00,000

(b) ₹ 5,84,000

(c) ₹ 58,400

(d) ₹ 60,000

Answer:

Or

XYZ Ltd. has in its Memorandum of Association, capital clause stating that it is formed with 7,500 equity shares of ₹ 100 each. The company has issued the entire shares and the public has also subscribed and paid up for the full amount on application itself. What will be the subscribed capital?

(a) ₹ 7,50,000

(b) ₹ 1,00,000

(c) ₹ 10,000

(d) ₹ 75,000

Answer:

(a) Subscribed capital (7,500 x 100) x = ₹ 7,50,000. Subscribed capital is equal to authorised capital, as complete capital has been subscribed by the public.

Question 12.

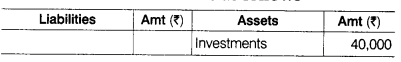

A and B are partners in a firm sharing profits in the ratio of 3 : 2. An extract of their balance sheet is as follows:

If half of the investments are taken over by A and B in their profit sharing ratio at book value, what amount of investments will be shown in revised balance sheet? [1]

(a) ₹ 40,000

(b) ₹ 20,000

(c) ₹ 10,000

(d) ₹ 80,000

Answer:

(b) Investments =40,000 – 50% of 40,000 (Taken over by partners) = ₹ 20,000

Question 13.

Assertion (A) Preliminary expenses are not shown in balance sheet.

Reason (R) Preliminary expenses are written-off in same year in which they are incurred.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer:

(a) As per AS-26, preliminary expenses are written-off in the same year in which they are incurred.

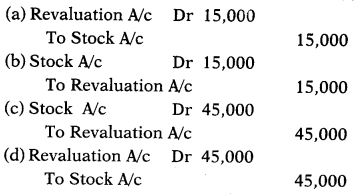

Question 14.

At the time of retirement of Mahesh, value of stock is given ₹ 60,000 in the balance sheet of the firm. Pass a journal entry when found stock is undervalued by ₹ 15,000. [1]

Answer:![]()

Question 15.

Which of the following statements is true about fixed and fluctuating capital account?

(a) Fixed capital account will always have a credit balance

(b) Current account can have a positive or a negative balance

(c) Fluctuating capital account can have a positive or negative balance

(d) All of the above

Answer:

(d) All of the above

Question 16.

Assertion (A) A charitable dispensary run by 10 members is deemed to be a partnership firm. Reason (R) For a partnership business, there must be a business and there must be sharing of profits among the partners from such business.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer:

(d) A charitable dispensary run by 10 members cannot be deemed to be a partnership firm because for a partnership business there must be a business with a motive to earn profits which should be shared among the partners of such business.

Question 17.

Ajay, Pranav and Vijay are in partnership sharing profits in the ratio of 4: 3: 1. Pranav takes retirement on 30th June, 2022. The firm’s profits for various years were : 2017 (profits ₹ 3,24,444 ), 2018 (profits ₹ 80,000), 2019 (profits ₹ 10,000), 2020 (losses ₹ 10,000), 2021 (profits ₹ 40,000) and 2022 (profits ₹ 50,000).

Ajay and Vijay decided to share future profits in the ratio of 3: 2. Goodwill is to be valued on the basis of 2 years’ purchase of average profit of 4 completed years immediately preceding the year of retirement of a partner. The accountant passed the following journal entry to record Pranav’s share of goodwill and missed some information. Fill in the missing figures in the following journal entry and give working notes.

Answer:

Firm’s goodwill = 30,000 x 2= 60,000

Pranav’s share of goodwill = 60,000 x 3/8 = 22500

Question 18.

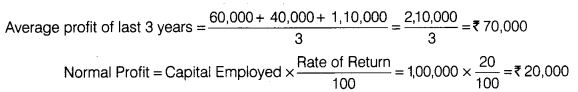

Calculate the value of goodwill by super profit method, when goodwill is to be valued at 2.5 years’ purchase of the average profits of the last 3 years. Profits of the previous 5 years are given below

2022 – ₹60,000,2021 – ₹40,000, 2020 – ₹ 1,10,000,2019 – ₹40,000, 2018 – ₹30,000

Capital investment of the firm is ₹ 1,00,000 and having rate of return is 20%.

Or Josh and Krish are partners sharing profits and losses in the ratio of 3: 1. Their capitals at the end of the financial year 2021-2022 were ₹ 1,50,000 and ₹ 75,000. During the year 2021-2022, Josh’s drawings were ₹ 20,000 and the drawings of Krish were ₹ 5,000. Profit before charging interest on capital for the year was ₹ 16,000 which was duly credited to their accounts. Krish had brought additional capital of ₹ 16,000 on 1st October, 2021. Calculate interest on capital (a) 12% per annum for the year 2021-2022.

Answer:

Super Profit = Average Profit — NormaI Profit = 70,000 — 20000 = 50000

Goodwill of the Firm = Super Profit x Number of Years’ Purchase = 50,000 x 2.5= 125,000

Or

Statement Showing Calculation of Capital at the Beginning

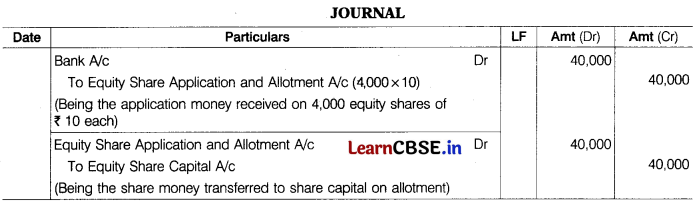

Question 19.

Makkar Ltd. invited applications for 4,000 equity shares of ₹ 10 each at the issue price of ₹ 10. The amount payable along with application is ₹ 10. This issue was fully subscribed. Give the journal entries for the above transactions.

Answer:

Or

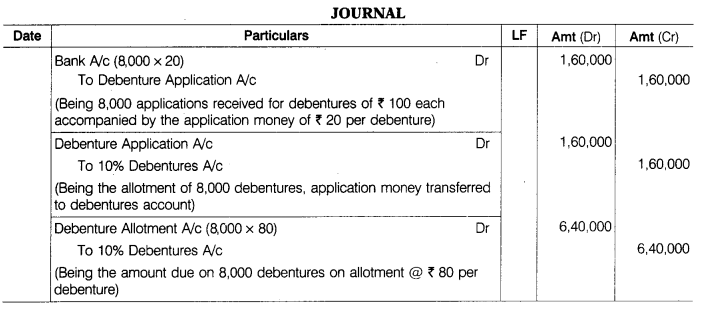

A company issued 8,000,10% debentures of ₹ 100 each, payable ₹ 20 on application and the remaining amount on allotment. The debentures are redeemable after 5 years. All the debentures were applied for and allotted. All money was received. Give the journal entries.

Answer:

Question 20.

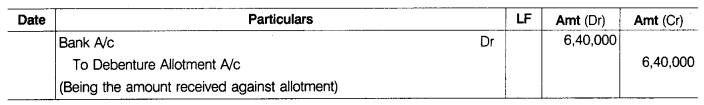

S and G are partners in a firm sharing profit and loss equally. On 1st April, 2021, the capital of the partners were ₹ 4,00,000 and ₹ 3,00,000 respectively. The profit and loss appropriation account of the firm showed a net profit of ₹ 7,74,000 for the year ended 31st March, 2022. The terms of partnership deed provided the following

(i) Transfer 10% of distributable profits to reserve fund.

(ii) Interest on capitals @ 6% per annum.

(iii) Interest on drawings @ 6% per annum. Drawings being S ₹ 80,000 and G ₹ 60,000.

(iv) S is entitled to a rent of ₹ 2,000 per month for the use of premises by the firm. It is paid to him by cheque at the end of every month. Prepare profit and loss appropriation account for the year ended 31st March, 2022.

Answer:

Note:

In the absence of date of drawings, interest on drawings has been calculated on an average basis for 6 months.

Working Note

Calculation of Amount Transferred to Reserve Fund

Distributable Profits = Profit + Interest on Drawings – Interest on Capital

= 7,50,000+2,400+1,800-24,000-18,000 = ₹ 7,12,200

Amount transferred to reserve fund = 7,12,200 x \(\frac{10}{100}\) = ₹ 71,220

Question 21.

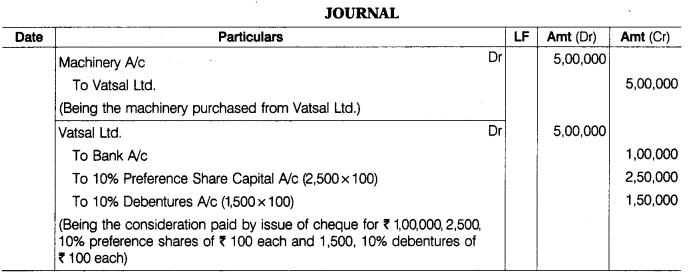

Karțik Ltd. purchased machinery from Vatsal Ltd. for ₹ 5,00,000. It made the payment as follows

₹ 1,00,000 by cheque,

2,500,10% preference shares of ₹ 100 each at par, and

1,500,10% debentures of ₹ 100 each at par.

You are required to pass the journal entries for the transactions.

Answer:

Question 22.

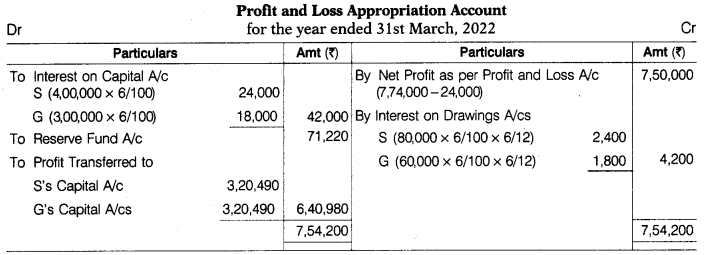

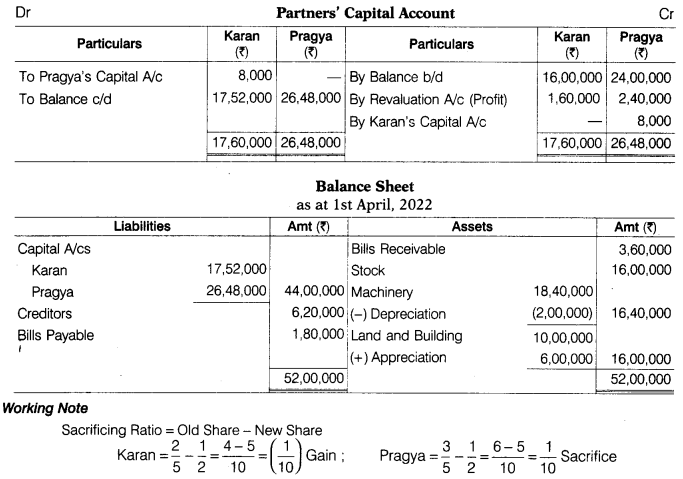

Karan and Pragya are partners in a firm sharing profits in the ratio of 2: 3. The balance sheet of the firm as on 31 st March, 2022 is given below:

The partners decided to share profits in equal ratio with effect from 1st April, 2022. The following adjustments were agreed upon

(i) Land and building was valued at ₹ 16,00,000 and machinery at ₹ 16,40,000 and were to appear at revalued amounts in the balance sheet.

(ii) The goodwill of the firm was valued at ₹ 80,000 but it was not to appear in books.

Prepare revaluation account, partners’ capital account and balance sheet. [4]

Answer:

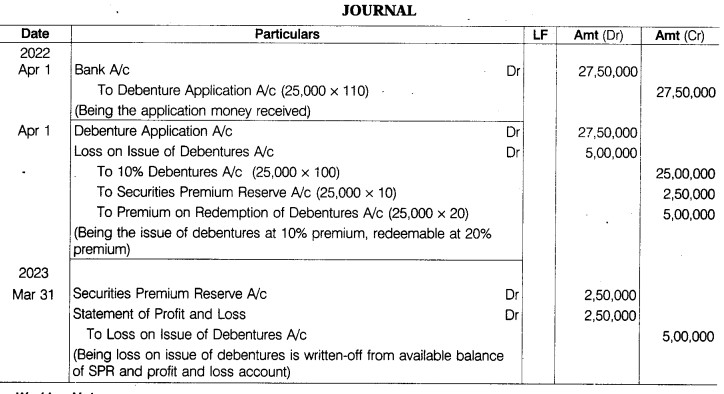

Question 23.

‘XYZ Ltd’ issued 25,000,10% debentures of ₹ 100 each at 10% premium to the public on 1st April, 2022, which are redeemable after 5 years of issue at a premium of 20%. Pass journal entry for the issue of debentures, for writing-off ‘loss on issue of debentures’ in the same year of issue and prepare ‘loss on issue of debenture account’ also. [6]

Answer:

Working Note

Securities premium reserve (By issue of 25,000,10% debentures of ₹ 100 each at 10% premium)

=25,000 x 10=₹ 2,50,000

Loss on issue of debentures =25,000 x 20 = ₹ 5,00,000

Loss on Issue of Debentures Account

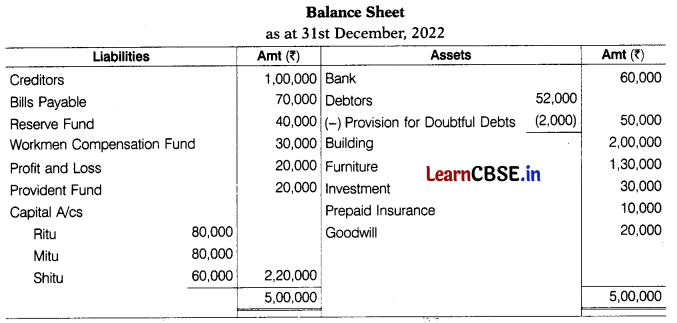

Question 24.

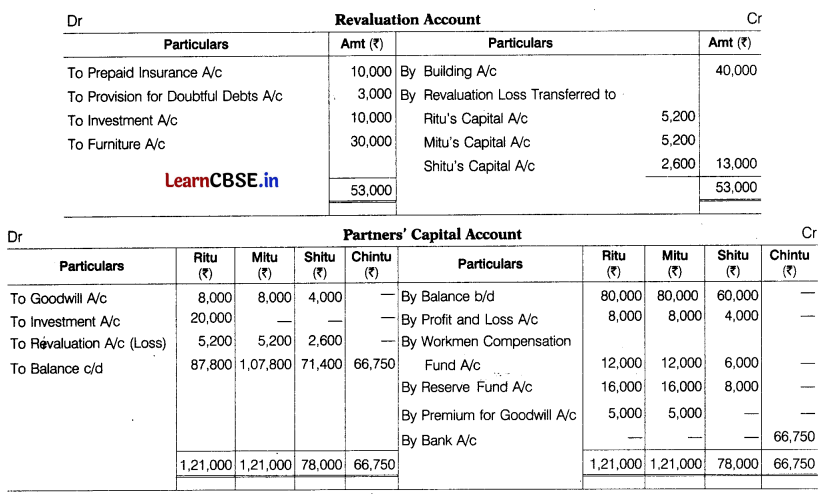

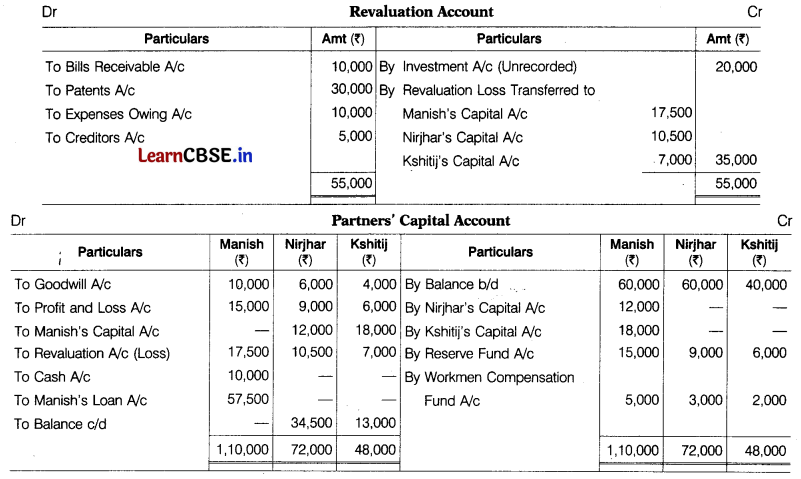

Ritu, Mitu and Shitu are partners with profit sharing ratio of 2: 2: 1. Their balance sheet is given below

Additional Information

(i) Chintu comes as a new partner and brings ₹ 66,750 as capital and his share of goodwill in cash.

(ii) New ratio is 3: 3: 2: 2.

(iii) Goodwill of the firm is ₹ 50,000

(iv) Prepaid insurance is no more required.

(v) Provision for doubtful debts is to be increased to ₹ 5,000.

(vi) Investment is valued at ₹ 20,000 and is taken over by Ritu.

(vii) Furniture valued at ₹ 1,00,000.

(viii) Building valued at 120%.

Prepare necessary accounts and balance sheet.

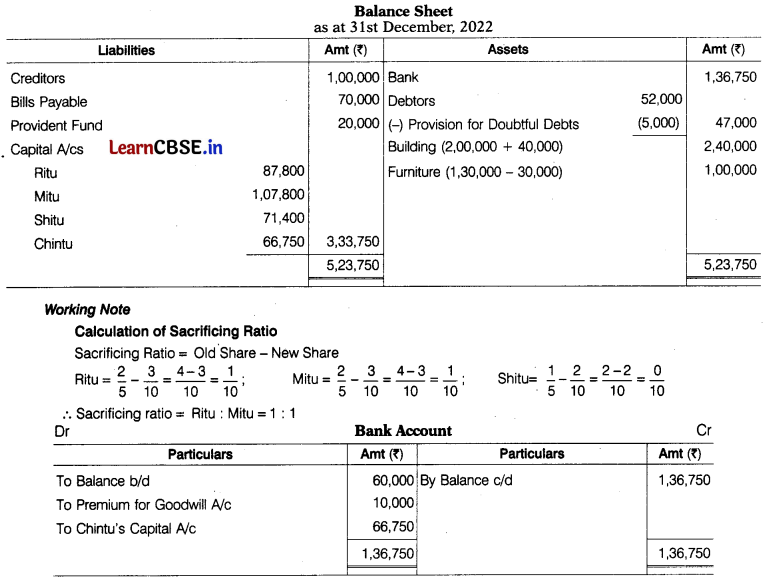

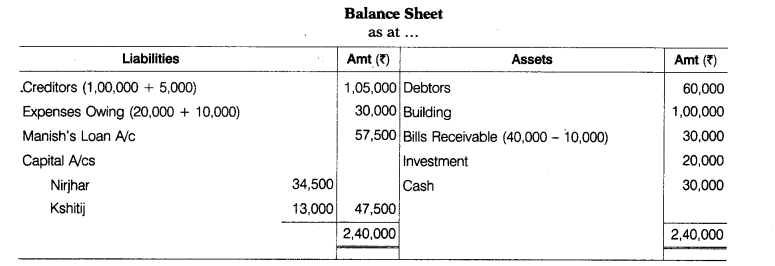

Or

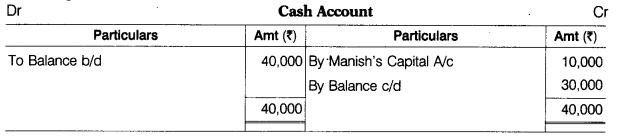

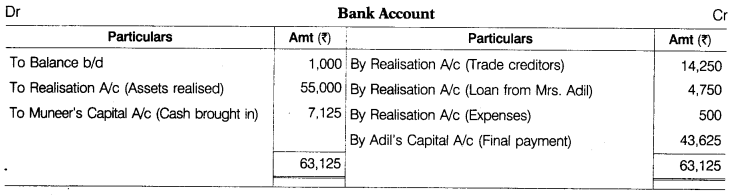

Manish, Nirjhar and Kshitij are partners with ratio of 5: 3: 2. [6]

Answer:

Additional Information

(i) Manish takes retirement.

(ii) New ratio of Nirjhar and Kshitij is 1: 1 and good will of the firm is valued at ₹ 60,000

(iii) Expenses owing increased by ₹ 10,000.

(iv) Creditors increased to ₹ 1,05,000.

(v) ₹ 10,000 bills receivable dishonoured and are not recoverable.

(vi) Patents are now value less.

(vii) ₹ 20,000 unrecorded investment brought into books.

(viii) ₹ 10,000 paid to Manish in cash and balance is transferred to his loan account.

Prepare necessary accounts and balance sheet.

Answer:

Working Note

Working Note

Gaining ratio = New share – Old share

Nirjhar = \(\frac{1}{2}-\frac{3}{10}=\frac{5-3}{10}=\frac{2}{10}\);

Kshitij =\( \frac{1}{2}-\frac{2}{10} = \frac{5-2}{10}=\frac{3}{10}\)

Gaining ratio = 2: 3

Manish’s share of goodwill =60,000 x 5/10 = ₹ 30,000, to be borne by Nirjhar and Kshitij in their gaining ratio,

i.e. 2: 3.

Question 25.

Adil and Muneer, who were sharing profits and losses in the ratio of 3: 1 respectively, decided to dissolve the firm on 31st March, 2022. Their balance sheet is as follows:

The assets (other than cash at bank) realised ₹ 55,000 and all creditors including loan from Mrs. Adil were paid-off less 5% discount. Realisation expenses amounted to ₹ 500. Prepare the redilisation account, bank account and the capital account of the partners assuming that both the partners are solvent.

Answer:

Question 26.

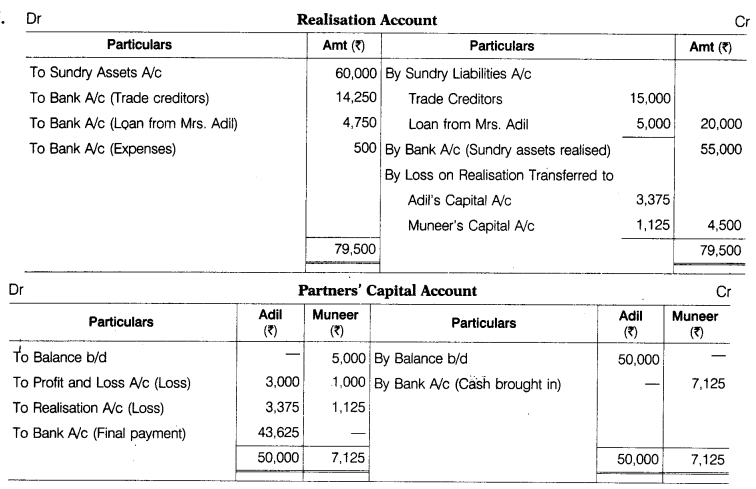

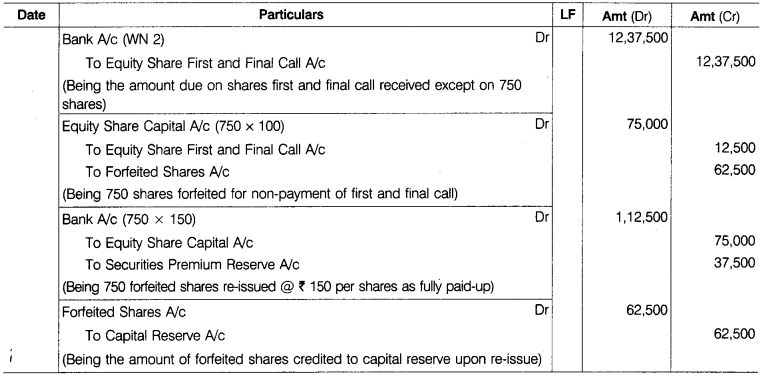

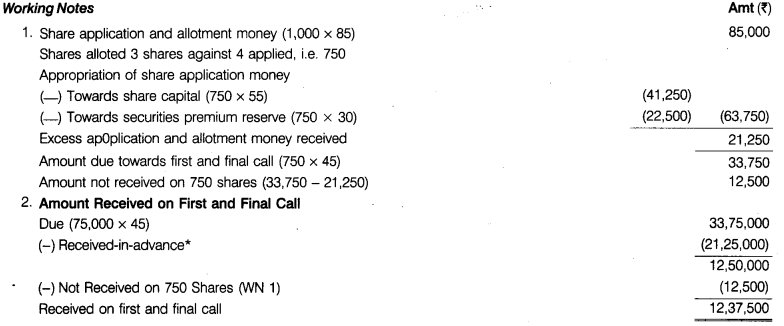

CANDID Ltd. invited applications for issuing 75,000 equity shares of ₹ 100 each at a premium of ₹ 30 per share. The amount was payable as follows

On application and allotment- ₹ 85 per share (including premium)

On first and final call-the balance amount

Applications for 1,27,500 shares were received. Applications for 27,500 shares were rejected and shares were allotted on pro-rata basis to the remaining applicants. Excess money received on application and alloment was adjusted towards sum due on first and final call. The calls were made.

A shareholder, who applied for 1,000 shares, failed to pay the first and final call money. His shares were forfeited. All the forfeited shares were re-issued at ₹ 150 per share fully paid-up.

Pass necessary journal entries for the above transactions in the books of CANDID Ltd. [6]

Answer:

Recevied in Advance = Total Amount Recerved on App4ication — Amount Refunded — Amount Adjusted in Capital and Securities Premium Reserve = 1,08,37,500 — 23.37500 — 4125.000 — 22,50,000 = 2125,000

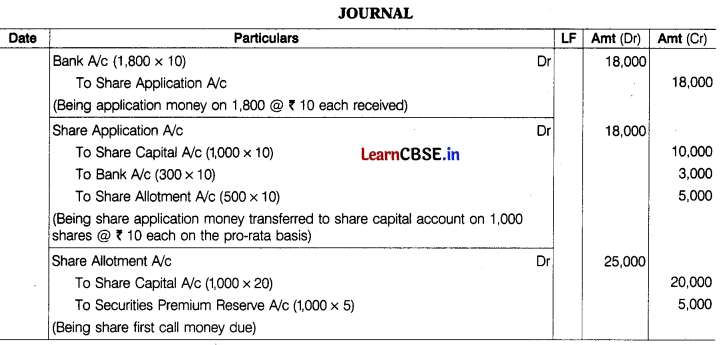

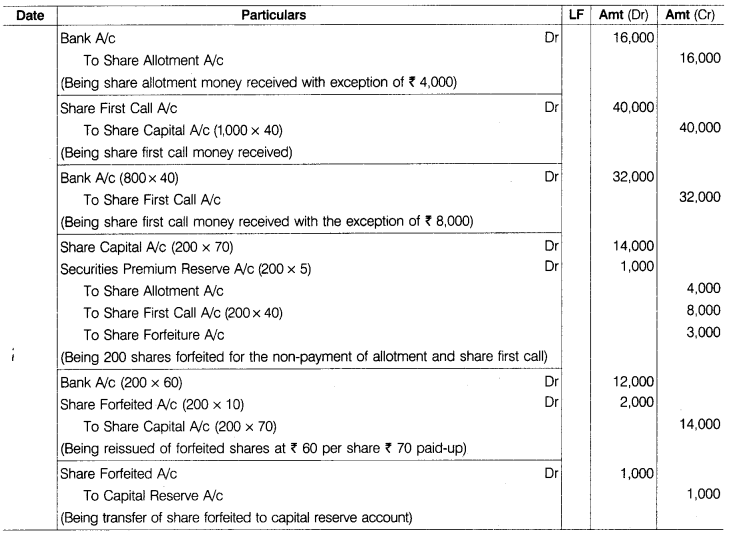

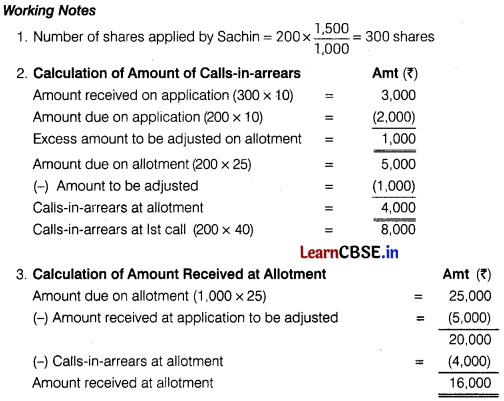

Or

Jatin Ltd. has been registered with an authorised capital of ₹ 2,00,000 divided into 2,000 shares of ₹ 100 each of which 1,000 shares were offered for public subscription at a premium of ₹ 5 per share payable as under On application ₹ 10; on allotment ₹ 25 (including premium); on first call ₹ 40 and on final call ₹ 30.

Applications were received for 1,800 shares of which applications for 300 shares were rejected outright, the rest of the applications were allotted 1,000 shares on pro-rata basis. Excess application money was transferred to allotment.

All the money were duly received except from Sachin, a holder of 200 shares, who failed to pay allotment and first call money. His shares were later on forfeited and re-issued to Shyam at ₹ 60 per share, as ₹ 70 paid-up. Final call has not been made. Record necessary journal entries.

Answer:

Section B

(Financial Statement Analysis)

Question 27.

Liquid ratio is calculated as ………….. [1]

Answer:

Liquid Ratio = \(\frac{\text { Current Assets }- \text { Inventories }- \text { Prepaid Expenses }}{\text { Current Liabilities }}\)

Or

Livestock is shown under which sub-head?

(a) Intangible fixed assets

(b) Inventories

(c) Trade receivables

(d) Tangible fixed assets

Answer:

(d) Tangible fixed assets

Question 28.

Gross profit is 20% of the net sales. Calculate the value of net sales, if cost of goods sold is ₹ 5,00,000.

(a) ₹ 6,00,000

(b) ₹ 5,00,000

(c) ₹ 6,25,000

(d) ₹ 6,50,000

Answer:

(c) If gross profit is 20 % of net sales, then it is 25% of the cost of goods sold.

Net Sales = COGS x \(\frac{25}{100}\)+5,00,000 = 5,00,000 x \(\frac{25}{100}\) +5,00,000

= 1,25,000 + 5,00,000 = ₹ 6,25,000

Question 29.

Statement I Dividend paid is always shown as operating activity.

Statement II Depreciation and amortisation, being non-cash expenses, are deducted from net profit before tax and extraordinary items.

Alternatives

(a) Both the statements are true

(b) Both the statements are false

(c) Statement I is true and Statement II false

(d) Statement II is true and Statement I is false

Answer:

(c) Statement I is true and Statement II false

Question 30.

Which of the following is not an investing cash flow?

(a) Purchase of marketable securities for cash

(b) Sale of land for cash

(c) Sale of shares (held as investment)

(d) Purchase of equipment for cash

Answer:

(a) Marketable securities are part of cash and cash equivalent

Or

X Ltd. purchased furniture for ₹ 20,00,000 paying 60% by issue of equity shares of ₹ 10 each and the balance by a cheque. This transaction will result in

(a) Cash used in investing activities ₹ 20,00,000.

(b) Cash generated from financing activities ₹ 12,00,000.

(c) Increase in cash and cash equivalents ₹ 8,00,000.

(d) Cash used in investing activities ₹ 8,00,000.

Answer:

(d) Cash used in investing activities ₹ 8,00,000.

Question 31.

XYZ Ltd. is in the process of preparing its balance sheet as per Schedule III, Part I of the Companies Act, 2013 and provides its true and fair view of the financial position.

(i) Under what head and sub-head will the company show stores and spares and loose tools in its balance sheet?

(ii) What is the accounting treatment of stores and spares and loose tools, when the company will calculate its inventory turnover ratio?

(iii) What is the objective of this analysis?

Answer:

(i) Head-Current Assets; Sub-head-Inventories.

(ii) While calculating inventory turnover ratio, these are not included in inventories.

(iii) Objectives of such analysis are

(a) Assessing the ability of the enterprise to meet its short-term and long-term commitments.

(b) Assessing the earning capacity of the enterprise.

Question 32.

What is meant by analysis of financial statements? State any two advantages of analysis of financial statements.

Answer:

The process of critical evaluation of the financial information contained in the financial statements in order to understand and make decisions regarding the operations of the firm is called analysis of financial statements. The advantages of analysis of financial statements are:

- It helps in determining the borrowing capacity of a prospective borrower.

- This analysis helps to assess the profit potential of the firm by identifying the key profit drivers and business risk.

Question 33.

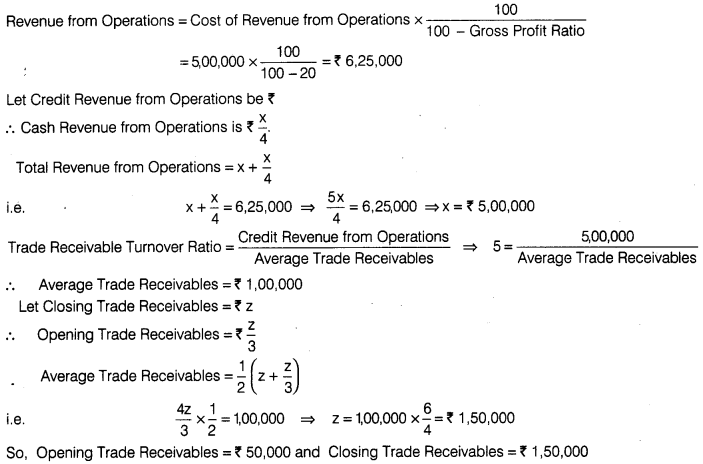

Calculate the amount of opening trade receivables and closing trade receivables from the following figures

Trade Receivables Turnover Ratio =5 times ; Gross Profit Ratio = 20%

Opening Trade Receivables were 1/3rd of Closing Trade Receivables.

Cash Revenue from Operations being 1/4 th of Credit Revenue from Operations.

Cost of Revenue from Operations is ₹ 5,00,000.

Answer:

Or

(i) From the following information, calculate Inventory Turnover Ratio : Net Sales ₹ 20,000; Average Inventory ₹ 2,750; Gross Loss on Sales is 10%.

(ii) From the following information, calculate Inventory Turnover Ratio : Total Sales ₹ 11,000; Sales Return ₹ 1,000; Gross Profit ₹ 2,500; Closing Inventory ₹ 3,000; Excess of Closing Inventory over Opening Inventory ₹ 1,000.

Answer:

Inventory Turnover Ratio = \(\frac{\text { Cost of Revenue from Operations }}{\text { Average Inventory }}=\frac{22,000}{2,750} \) = 8 times

Working Note

Net Sales = ₹ 20,000

Gross Loss = 10% of ₹ 20,000 = ₹ 2,000

Cost of Revenue from Operations = Net Sales + Gross Loss =20,000+2,000=₹ 22,000

Average Inventory

Working Note

Net Sales =₹ 20,000

Gross Loss =10% of ₹ 20,000 = ₹ 2,000

Cost of Revenue from Operations = Net Sales + Gross Loss =20,000+2,000 = ₹ 22,000

(ii) Inventory Turnover Ratio = \(\frac{\text { Cost of Revenue from Operations }}{\text { Average Inventory }}=\frac{7,500}{2,500}\) = 3 times

Working Notes

1. Calculation of Inventory

Opening Inventory = Closing Inventory – Excess of Closing Inventory over Opening Inventory

=3,000 – 1,000 = ₹ 2,000

Average Inventory =( Opening Inventory + Closing Inventory )+2=(2,000+3,000) ÷ 2 = ₹ 2,500

2. Cost of Revenue from Operations = Net Sales – Gross Profit =10,000-2,500=₹ 7,500

Question 34.

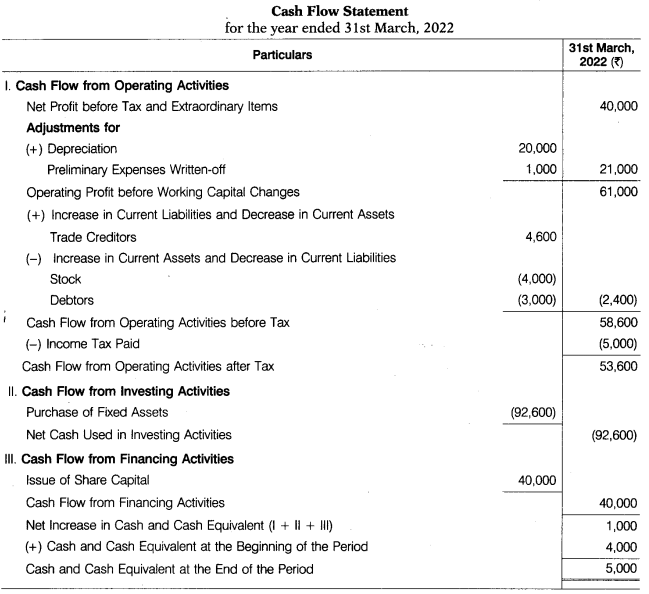

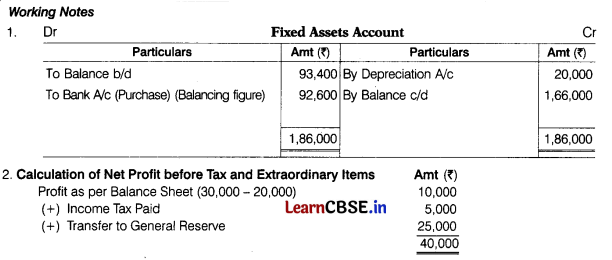

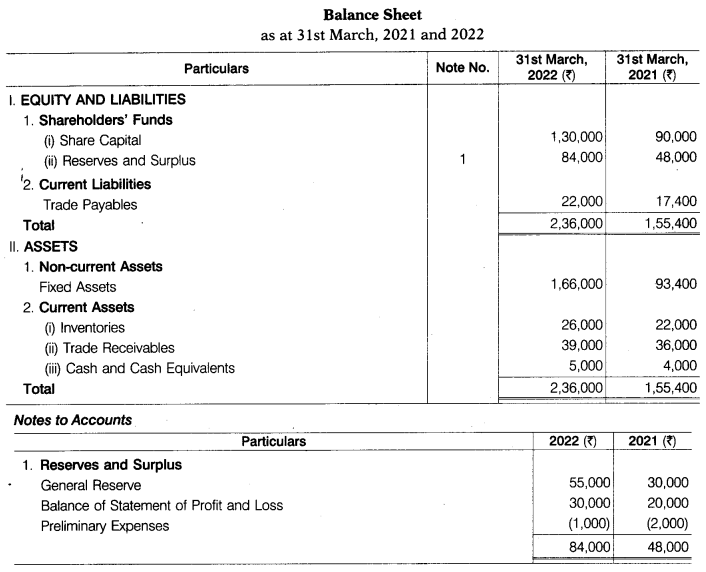

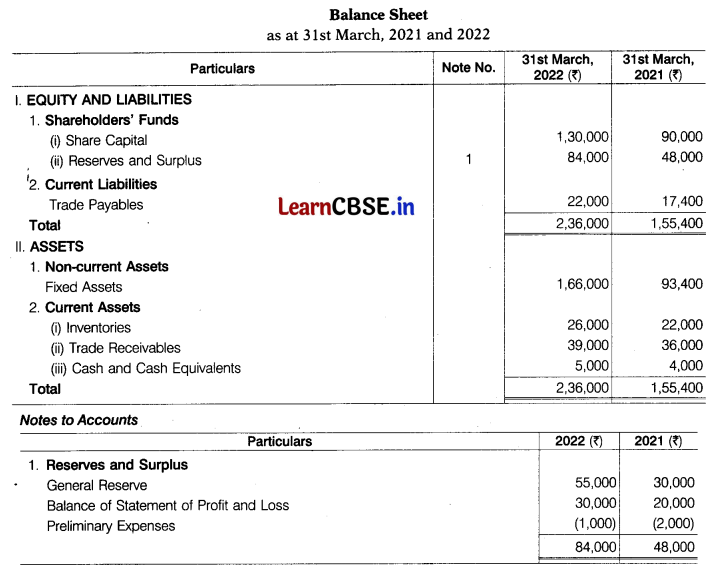

From the following balance sheet of Vikas Ltd. as on 31st March, 2022 and 2021, prepare a cash flow statement

Additional Information

(i) Depreciation charged on fixed assets for the year 2021-22 was ₹ 20,000.

(ii) Income tax ₹ 5,000 has been paid during the year. [6]

Answer: