CBSE Sample Papers for Class 12 Accountancy Set 2 with Solutions

Students must start practicing the questions from CBSE Sample Papers for Class 12 Accountancy with Solutions Set 2 are designed as per the revised syllabus.

CBSE Sample Papers for Class 12 Accountancy Set 2 with Solutions

Time :3 hrs

Max. Marks: 80

Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Part-A has Accounting for Partnership Firms and Companies.

- Part-B has Analysis of Financial Statements.

- Questions Nos. 1 to 16 and 27 to 30 carries 1 mark each.

- Questions Nos. 17 to 20, 31 and 32 carries 3 marks each.

- Questions Nos. from 21, 22 and 33 carries 4 marks each

- Questions Nos. from 23 to 26 and 34 carries 6 marks each

- There is no overall choice. However, an internal choice has been provided in 7 questions of

one mark, 2 questions of three marks, 1 question of four marks and 2 questions of six marks.

Part A

(Accounting for Partnership Firms and Companies)

Question 1.

Zen Ltd purchased a machinery from Kisan Ltd for ₹ 2,25,000. Zen Ltd. immediately paid ₹ 45,000 by bank draft and the balance by issue of preference shares of ₹ 100 each at 20% premium for the purchase consideration of machinery. Number of preference shares issued will be………. [1]

(a) 1,500

(b) 15,000

(c) 1,800

(d) 18,000

Answer:

(a) Number of shares issued = \(\frac{2,25,000-45,000}{100+20} \) =1,500

![]()

Question 2.

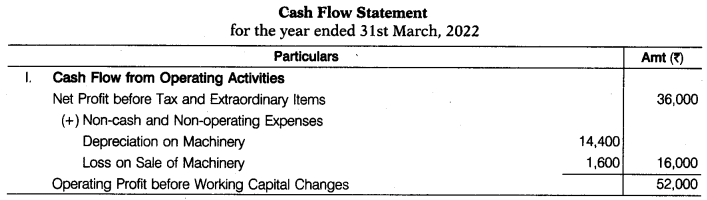

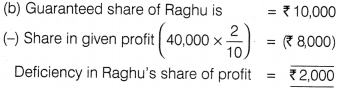

Ram, Raghav and Raghu are partners in a firm sharing profits in the ratio of 5 : 3 : 2. As per partnership deed, Raghu is to get a minimum amount of 10,000 as profit. Net profit for the year is 40,000. Calculate deficiency (if any) to Raghu. [1]

(a) 750

(b) 2,000

(c) 1,500

(d) None of these

Answer:

Question 3.

Assertion (A) Minimum amount of discount allowed at the time of re-issue of forfeited shares should not exceed the forfeited amount.

Reason (R) The excess amount of forfeited shares account is transferred to capital reserve account. [1]

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer:

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

Question 4.

Which of the following statements is correct about debenture trust deed? [1]

(a) It shows the list of debenture holders

(b) It protects the interest of debentureholciers

(c) It is created after public subscription

(d) It tells that in case of losses, there will be no interest

Answer:

(b) It protects the interest of debentureholders

Question 5.

‘ X ‘, ‘ Y’ and ‘Z’ are partners sharing profits in the ratio of 3: 2: 1. They agree to admit ‘ G ‘ into the firm. ‘ X ‘, ‘ Y’ and ‘ Z’ agreed to give 1/3 rd, 1/6 th and 1/9th share of their profit. The share of profit of ‘ G ‘ will be ………….

(a) \(\frac{11}{54}\)

(b) \( \frac{13}{54} \)

(c) \( \frac{1}{10}\)

(d) \( \frac{12}{54}\)

Or

What will be the amount of interest, if a partner withdrew ₹ 1,000 at the end of each month from 1st June, 2022 till the end of the accounting year upto 31st March, 2023? Interest on drawings is 12% per annum.

(a) ₹ 550

(b) ₹ 600

(c) ₹ 575

(d) ₹ 700

Answer:

(b) G’s share = \(\frac{3}{6} \times \frac{1}{3}+\frac{2}{6} \times \frac{1}{6}+\frac{1}{6} \times \frac{1}{9}\)

\(=\frac{3}{18}+\frac{2}{36}+\frac{1}{54}=\frac{18+6+2}{108}=\frac{13}{54}\)

Or

(a) Interest on Drawings = Amount of Drawings x No, of Months x Rate x Period

= 1,000 x 10 x 12 / 100 x 5.5 / 12 = ₹ 550

![]()

Question 6.

A, B and C are partners sharing profits equally. A drew regularly ₹ 4,000 in the beginning of every month for the six months ended 30th September, 2020. Calculate interest on A’s drawings @ 5% p.a.

(a) ₹ 200

(b) ₹ 1,200

(c) ₹ 350

(d) ₹ 700

Answer:

(c) Interest on A’s Drawings = Total Drawings

x \(\frac{\text { Rate of Interest }}{100}\) x \(\frac{\text { Average Period }}{12} \)

= 4,000 x 6 x \(\frac{5}{100}\) x \(\frac{3.5}{12}\) = ₹ 350

Question 7.

In a firm, 10% of net profit after deducting all adjustments, including reserve is transferred to general reserve. Net profit after all adjustments but before transfer to general reserve is ₹ 44,000. Amount to be transferred to reserve is ……….

(a) ₹ 2,500

(b) ₹ 4,000

(c) ₹ 4,400

(d) ₹ 2,200

Answer:

(b) Amount transferred to reserve

= 44,000 x 10/110 = ₹ 4,000

Question 8.

Assertion (A) Change in profit sharing ratio among existing partners results in reconstitution of partnership firm.

Reason (R) The relationship among partner changes at the time of change in profit sharing ratio.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

Question 9.

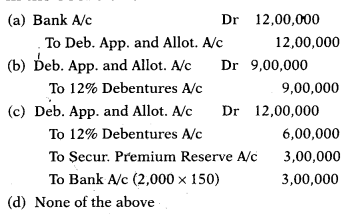

Goel Ltd invited applications for issuing 6,000, 12% debentures of 100 each at a premium of 50 per debenture. The full amount was payable on application. Applications were received for 8,000 debentures.

Applications for 2,000 debentures were rejected and application money was refunded. Debentures were allotted to the remaining applicants. Based on the information, pass the journal entry for adjusting the application money received in the books of Goel Ltd.

Or

X Ltd issued 10,000, 8% debentures of 10 each, payable on application and redeemable at par at any time after 6 years. Record the entries for the application money received in the books of X Ltd.

Answer:

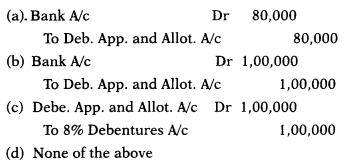

Direction Read the following hypothetical situation and answer Q. No.10 and 11 X and Y are partners with capitals of ₹ 6,50,000 and ₹ 5,50,000 respectively. They admit Z as a partner with 1/4th share in the profit of the firm. Following journal entries are passed.

Question 10.

Total capital of the firm will be …………..

(a) ₹ 6,50,000

(b) ₹ 7,50,000

(c) ₹ 26,00,000

(d) ₹ 18,50,000

Answer:

(c) Total capital of the firm on the basis of Z’s capital = ₹ 6,50,000 x 4/1 = ₹ 26,00,000

![]()

Question 11.

Z’s share of good will will be …………..

(a) ₹ 7,50,000

(b) ₹ 1,87,500

(c) ₹ 1,97,500

(d) ₹ 1,62,500

Answer:

(b) (i) Total Capital of the Firm on the basis of Z’s

Capital = ₹ 6,50,000 x \(\frac{4}{1}\) = ₹ 26,00,000

(ii) Actual Capital of New Firm =6,50,000

+ 5,50,000 + 6,50,000 = ₹ 18,50,000

(iii) Firm’s Goodwill [(i) – (ii)] =26,00,000-

18,50,000 = ₹ 7,50,000

Z’s Share of Goodwill =7,50,000 x 1/4

= ₹ 1,87,500

Question 12.

Which of the following appears in profit and loss appropriation account?

(i) Interest on partner’s capital.

(ii) Interest on the partner’s loan.

(iii) Manager’s commission on net profit. Codes

(a) (i), (ii), (iii)

(b) (ii) and (iii)

(c) Only (iii)

(d) Only (i)

Or

Other than minors, ………… categories of individuals cannot be admitted in a partnership firm.

(a) person of unsound mind

(b) person disqualified by the law

(c) Both (a) and (b)

(d) None of the above

Answer:

(d) Only (i)

Or

(c) Both (a) and (b)

Question 13.

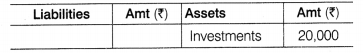

X and Y are partners in a firm sharing profits in the ratio of 3 : 2. An extract of their balance sheet is as follows

If half of the investments are taken over by X and Y in their profit sharing ratio at book value, what amount of investments will be shown in revised balance sheet? [1]

(a) 20,000

(b) 10,000

(c) 5,000

(d) 40.000

Or

X and Y are partners sharing profits in the ratio of 10 : 2. Z is admitted and the new profit sharing ratio is now 10: 6 : 4 At the date of admission, general reserve appears in the books at 24,000. Y’s share in the reserve will be …..

(a) 4,000

(b) 20,000

(c) 7,200

(d) None of these

Answer:

(b) Investments =20,000 — (50% of 20000)

= 10000

Or

(a) Ys share in reserve = 24.000 x 2/12= 4,000

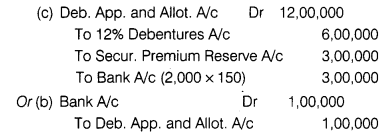

![]()

Question 14.

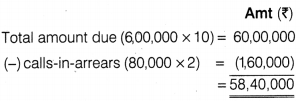

Amox Ltd is registered with a capital of 10,00,000 equity shares of ₹ 10 each. 6,00,000 equity shares were offered for subscription to public. Applications were received for 6,00,000 shares. All calls were made and amount was duly received except final call of ₹ 2 on 80,000 shares. What will be the amount of share capital shown in the balance sheet? (1)

(a) ₹ 60,00,000

(b) ₹ 58,40,000

(c) ₹ 5,84,000

(d) ₹ 6,00,000

Answer:

(b) 10

Or

If a share of 10 on which 8 has been called and 6 is paid is forfeited, the share capital account should be debited with

(a) ₹ 8

(b) ₹ 10

(c) ₹ 6

(d) ₹ 2

Answer:

(a) ₹ 8

Question 15.

State the right order of deductions for presenting a correct view of the profit and loss appropriation account.

(i) Interest on the partner’s loan.

(ii) Manager’s commission on net profit.

(iii) Interest on partner’s capital.

(a) (i) → (ii) → (iii)

(b) (ii) → (iii) → (i)

(c) (iii) → (i) → (ii)

(d) (i) → (iii) → (ii)

Answer:

(a) (i) → (ii) → (iii)

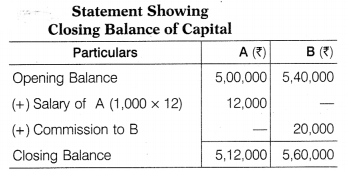

Question 16.

Find the closing balance of capital account from the given information.

Opening balance of capital account as at 1st April, 2022 of A and B are ₹ 5,00,000 and ₹ 5,40,000 respectively. A is entitled to take salary for ₹ 1,000 per month and B is to take commission for ₹ 20,000.

(a) A = ₹ 5,40,000, B = ₹ 5,80,000

(b) A = ₹ 5,00,000, B = ₹ 5,40,000

(c) A = ₹ 5,12,000, B = ₹ 5,60,000

(d) A = ₹ 5,60,000, B = ₹ 5,12,000

Answer:

(c)

![]()

Question 17.

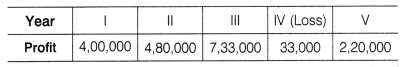

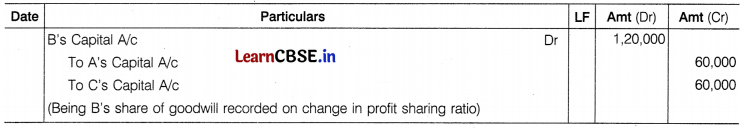

A, B and C were partners in a firm. Because of increase in business activities, Bhad to devote more time.

B demanded that his share in the profits of the firm be increased, to which A and C agreed. The new profit sharing ratio was agreed to be 1: 2: 1. For this purpose, the goodwill of the firm was valued at two years’ purchase of the average profits of last five years. The profits of the last five years were as follows:

You are required to

(i) Calculate the goodwill of the firm.

(ii) Pass necessary journal entry for the treatment of goodwill on change in profit sharing ratio. (3)

Or

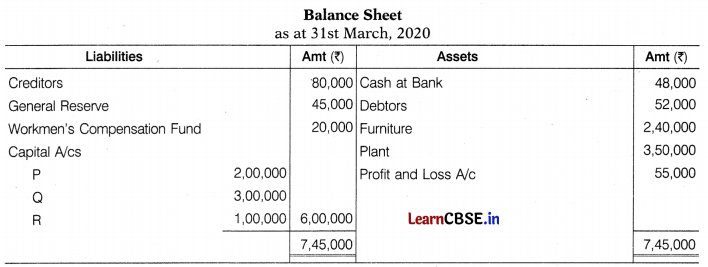

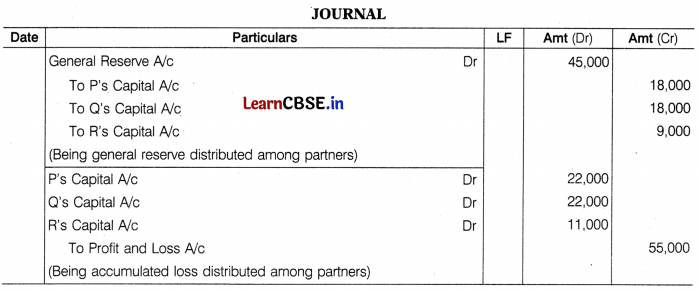

P, Q and R were partners in a firm sharing profits in the ratio of 2 :2 : 1. P died on 31st March, 2020. The balance sheet of the firm on that date was as under

On P’s death, a claim of ₹ 12,000 was accepted for workmen’s compensation.

Pass necessary journal entries for general reserve, profit and loss account and workmen’s compensation fund, in the books of the firm

Answer:

(i) Calculation of Goodwill of the Firm

Average profits = \(\frac{4,00,000+4,80,000+7,33,000-33,000+2,20,000}{5} = \frac{18,00,000}{5}\)

= ₹ 3,60,000

Goodwill = Average Profits x Number of Years’ Purchase = 3,60,000 x 2 = ₹ 7,20,000

Working Note

Calculation of Sacrifice or Gain of each Partner

Sacrificing/Gaining Share = Old Share – New Share

A = \(\frac{1}{3}-\frac{1}{4}=\frac{4-3}{12}=\frac{1}{12}\) Sacrifice ;

B = \(\frac{1}{3}-\frac{2}{4}=\frac{4-6}{12}=\left(\frac{2}{12}\right) \)Gain;

C = \(\frac{1}{3}-\frac{1}{4}=\frac{4-3}{12}=\frac{1}{12} \) Sacrifice

B will pay for goodwill = 7,20,000 x 2/12 = ₹ 1,20,000

Value Point

In the absence of any information, profits are to be shared equally. Thus old PSR is 1: 1: 1.

Or

Question 18.

Rashid and Komal are partners in a firm. Their capitals are: Rashid ₹ 30,000 and Komal ₹ 20,000. During the year ended 31st March, 2020, the firm earned a profit of ₹ 15,000. Assuming that the normal rate of return is 20%, calculate the value of goodwill of the firm of Rashid and Komal.

(i) By capitalisation method; and

(ii) By super profit method, if the goodwill is valued at 4 years’ purchase of super profit.

Answer:

(i) Capitalisation Method

Total Capitalised Value of the Firm = \(\frac{\text { Average Profit } \times 100}{\text { Normal Rate of Return }}=\frac{15,000 \times 100}{20}\) = ₹ 75,000

Goodwill of the Firm = Total Capitalised Value of Business – Capital Employed

= 75,000-50,000[ i.e., 30,000 (Rashid) +20,000 (Komal) ]= ₹ 25,000

(ii) Super Profit Method

Normal Profit = Capital Employed x Normal Rate of Return / 100 = 50,000 x \(\frac{20}{100}\) = ₹ 10,000

Average Profit = ₹ 15,000

Super Profit = Average Profit – Normal Profit = 15,000-10,000 = ₹ 5,000

Goodwill of the Firm = Super Profit x Number of Years’ Purchase = 5,000 x 4 = ₹ 20,000

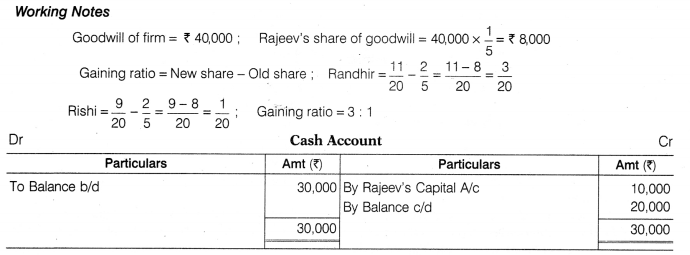

![]()

Question 19.

A and B decided to start a partnership firm. They contributed capitals of ₹ 2,00,000 and ₹ 1,00,000 on 1st April, 2017. A expressed his willingness to admit C as a partner without capital, B agreed to this. On 1st October, 2017, B granted a loan of ₹ 1,20,000 to the firm.

The terms of partnership were as follows

(i) A, B and C will share profits in the ratio of 2: 2: 1.

(ii) Interest on capital @ 6% per annum. Interest on drawings @ 5%.

(iii) A to get a monthly salary of ₹ 3,000 and B to get salary of ₹ 4,000 per quarter.

(iv) 10% of the profits before charging interest on drawings but after making appropriations are to be transferred to general reserve.

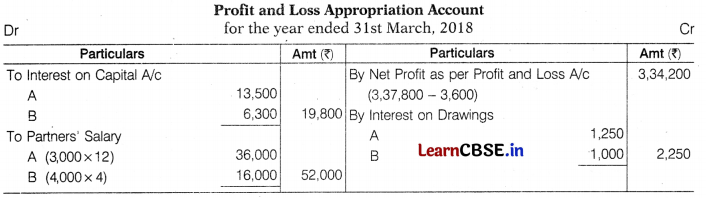

Due to shortage of capital, A contributed 50,000 on 30th September, 2017 and B contributed 20,000 on 1st January, 2018 as additional capital. The profit of the firm for the year ended 31st March, 2018 was 3,37,800. Drawings of A and B were 50,000 and 40,000 respectively. Prepare profit and loss appropriation account for the year ending 31st March, 2018. [3]

Answer:

Working Notes

1. Calculation of Interest on Capital

A On 2,00,000=2,00,000 x \(\frac{6}{100}\) =₹ 12,000 ; On 50,000=50,000 x \(\frac{6}{100}\) x \(\frac{6}{12}\) = ₹ 1,500

Total interest on A’s capital =12,000+1,500=₹ 13,500

B On 1,00,000=1,00,000 x \(\frac{6}{100}\) = ₹ 6,000 ; On 20,000=20,000 x \(\frac{6}{100}\) x \(\frac{3}{12}\) = ₹ 300

Total interest on B’s capital =6,000+300=₹ 6,300

2. Calculation of Interest on Drawings

A=50,000 x \(\frac{5}{100}\) x \(\frac{6}{12}\) = ₹ 1,250 ;

B=40,000 x \( \frac{5}{100}\) x \(\frac{6}{12}\) = ₹ 1,000

3. Transfer to reserve =10 % of (3,34,200-19,800 – 52,000) = ₹ 26,240

4. Interest on loan =1,20,000 x 6/100 x 6/12 = ₹ 3,600

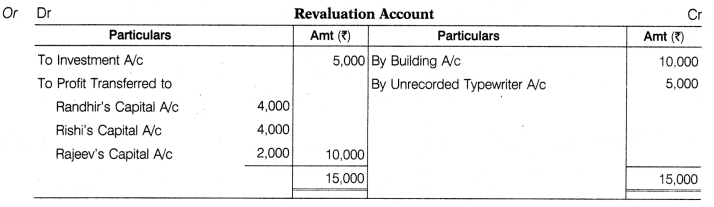

Question 20.

Malakar’s Ltd is authorised with a capital of ₹ 50,00,000 divided into 50,000 shares of ₹ 100 each. The company issued 30,000 shares to the public for subscription. The company received application for 25,000 shares. In 1st year, ₹ 80 is called by the company.

Ranjeet and Sandeep are two shareholders holding 2,000 and 4,000 shares respectively. Both the shareholders did not paid first call money of ₹ 20 per share. Sandeep’s shares were forfeited by the company after first call and later on 3,000 shares out of forfeited were re-issued at ₹ 60 per share as ₹ 80 called-up.

Show the following

Share capital in the balance sheet of the company as per Schedule III, Part I of the Companies Act, 2013 and prepare notes to accounts for the same.

Or

Complete the missing information

Answer:

![]()

Question 22.

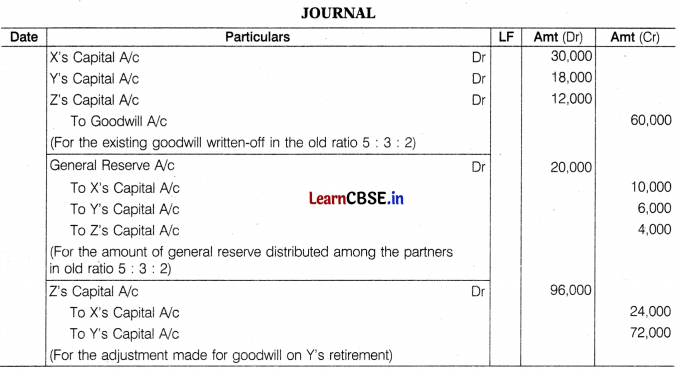

X, Y and Z were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Goodwill appeared in their books at a value of ₹ 60,000 and general reserve at ₹ 20,000. Y decided to retire from the firm. On the date of his retirement, good will of the firm was valued at ₹ 2,40,000. The new profit sharing ratio decided among X and Z was 2 : 3. Record necessary journal entries on Y’s retirement. [4]

Answer:

Working Note

Calculation of Gaining Ratio = New Ratio – Old Ratio

X=2/5 – 5/10 = – 1/10 (sacrifice); Z = 3/5-2/10 = 4/10 (gain)

Question 23.

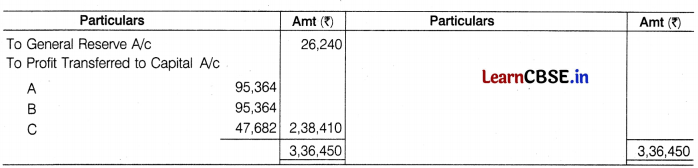

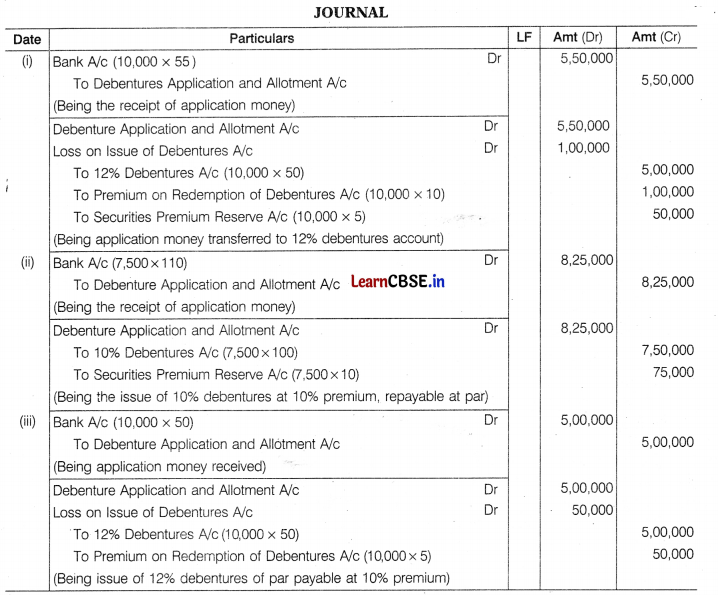

Pass the necessary journal entries for the issue of debentures in the following cases

(i) 10,000,12 % debentures of ₹ 50 each issued at 10 % premium, repayable at 20 % premium.

(ii) 7,500,10 % debentures of ₹ 100 each issued at 10 % premium, repayable at par.

(iii) 10,000,12 % debentures of ₹ 50 each issued at par, repayable at 10 % premium.

Answer:

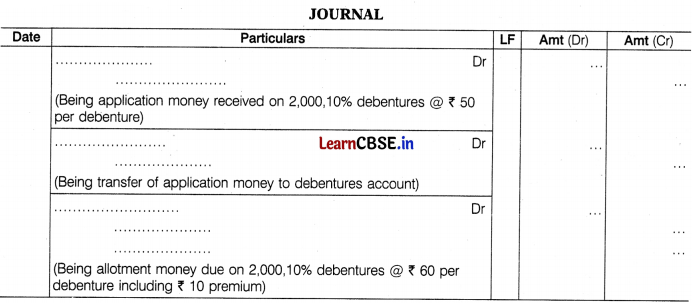

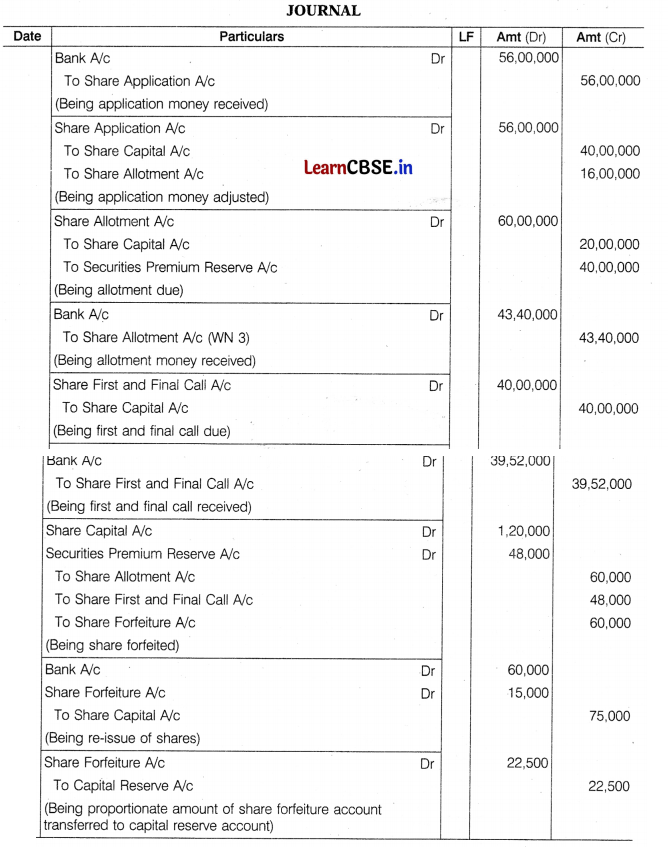

Question 24.

Kanso Ltd issued 10,00,000 shares of ₹ 10 each at a premium of ₹ 4 per share payable as follows

₹ 4 on application

₹ 6 on allotment

₹ 4 on call

Applications were received for 14,00,000 shares and pro-rata allotment was made as follows:

To the applicants of 10,00,000 shares, 8,00,000 shares were issued and for the rest, 2,00,000 shares were issued. All money due were received except the allotment and call money from Viresh who had applied for 15,000 shares (out of the group of 10,00,000 shares). All his shares were forfeited. 7,500 of the forfeited shares were re-issued for ₹ 8 per share fully paid-up. Pass necessary journal entries for the above transactions.

Or

Ram Ltd invited applications for 8,00,000 equity shares of ₹ 10 each at a premium of ₹ 40 per share. The amount was payable as follows

On application ₹ 35 per share (including ₹ 30 premium)

On allotment -₹ 8 per share (including ₹ 4 premium)

On first and final call – Balance

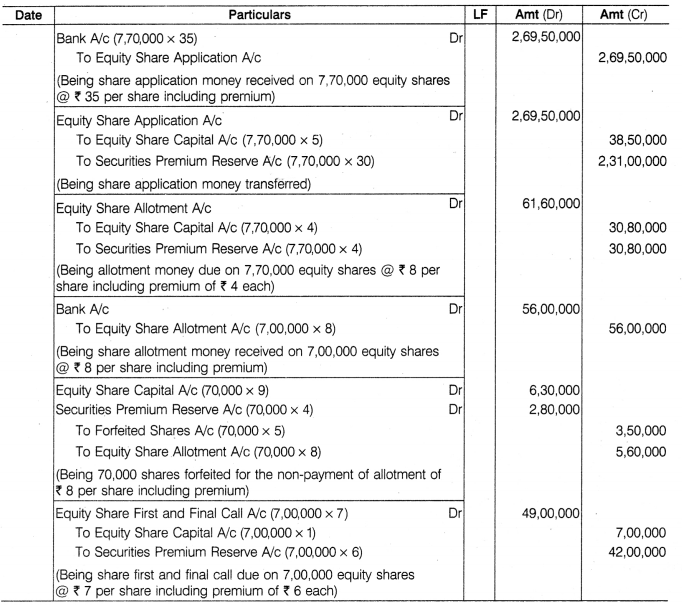

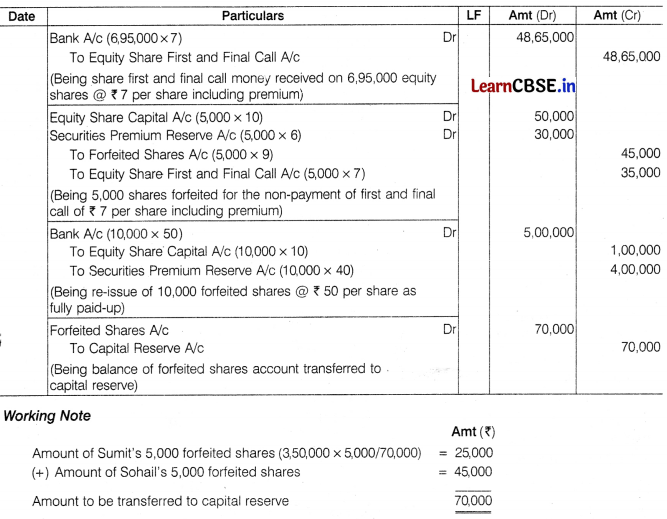

Applications for 7,70,000 shares were received. Shares were allotted to all the applicants. Sumit to whom 70,000 shares were allotted failed to pay the allotment money. His shares were forfeited immediately after allotment. Afterwards, the first and final call was made. Sohail, the holder of 5,000 shares failed to pay the first and final call. His shares were also forfeited. Out of the forfeited shares 10,000 shares were re-issued at 50 per share fully paid-up. The re-issued shares included all the shares of Sohail. Pass necessary journal entries for the above transactions in the books of Ram Ltd.

Answer:

Working Notes

1. Excess amount received from Viresh on application Viresh has applied for 15,000 shares.

Or

Journal

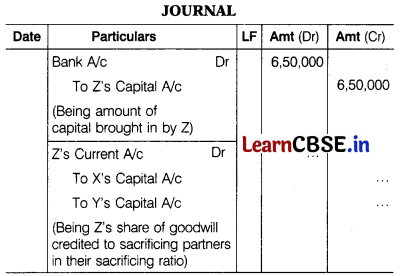

Question 25.

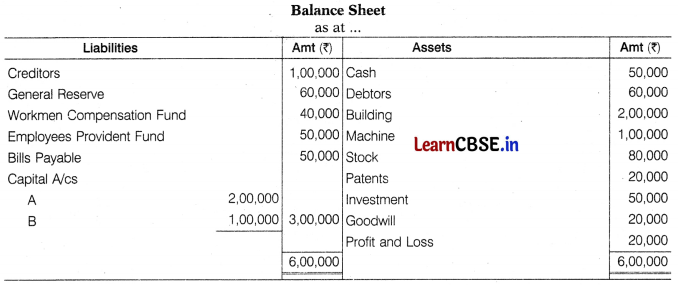

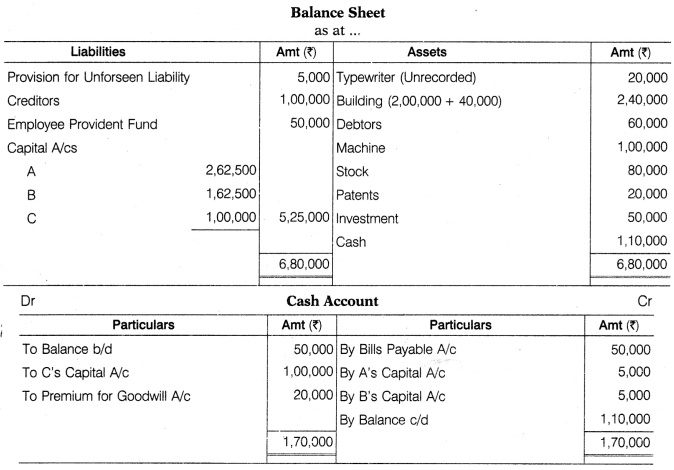

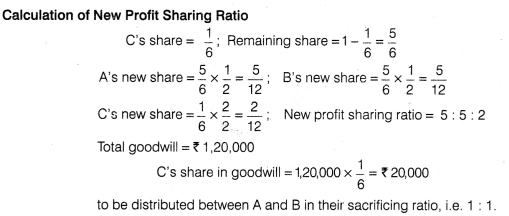

A and B are partners sharing profits and losses in the ratio of 1:1. Following is their balance sheet

![]()

Additional Information

(i) C comes for 1/6 th share and brings capital of ₹ 1,00,000 and proportionate share in goodwill.

(ii) Goodwill of the firm is valued at ₹ 1,20,000.

(iii) Half the premium is withdrawn by old partners.

(iv) ₹ 20,000 unrecorded typewriter brought into books.

(v) Make ₹ 5,000 provision for unforseen liabilities.

(vi) Bills payable paid-off.

(vii) Building was found undervalued by ₹ 40,000

Prepare revaluation account, partners’ capital accounts, cash account and balance sheet of the new firm.

Answer:

![]()

Question 26.

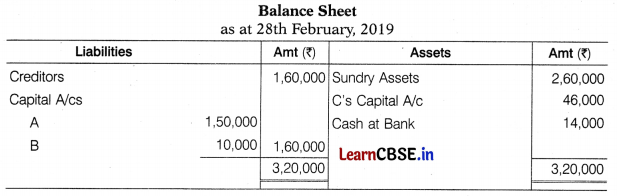

A, B and C were partners in a firm sharing profits in the ratio of 2 : 2: 1. On 28th February,2019, their firm was dissolved. On this date, firm’s balance sheet is as follows:

C took over the assets at ₹ 1,30,000. Realisation expenses ₹ 10,000 were paid by A. Creditors of ₹ 1,60,000 were paid by A at ₹ 1,50,000. You are required to prepare realisation account, partner’s capital account and cash account.

Answer:

Part B

(Financial Statement Analysis)

Question 27.

Statement I Credit purchases of goods will increase the operating ratio. Statement II Payment to creditors will increase the operating ratio. Alternatives

(a) Both the statements are true

(b) Both the statements are false

(c) Statement I is true and Statement II is false

(d) Statement II is true and Statement I is false

Or

Which one of the following is not an item of securities premium reserve?

(a) Revaluation reserve

(b) Securities premium reserve

(c) Share options outstanding account

(d) None of these

Answer:

(c) Statement I is true and Statement II is false.

Or

(d) None of these

![]()

Question 28.

Which of the following will decrease the inventory turnover ratio?

(a) Increase in the value of closing stock

(b) Purchase return

(c) Goods distributed as free samples

(d) Goods withdrawn for personal use

Answer:

(a) Purchase return, goods distributed as free samples and goods withdrawn for personal use will increase the inventory turnover ratio.

Question 29.

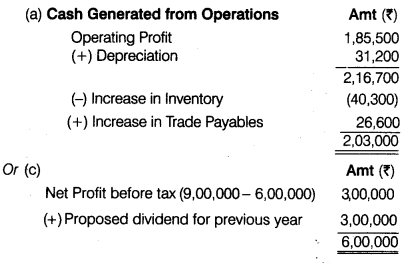

Rakshak Ltd made an operating profit of ₹ 1,85,500 after charging depreciation of ₹ 31,200. During that year, trade payables increased by ₹ 26,600 and inventory increased by ₹ 40,300. There was no change to trade receivables. Assuming that no other factors affected it, what would be the cash generated from operations?

(a) ₹ 2,03,000

(b) ₹ 2,30,400

(c) ₹ 2,25,800

(d) ₹ 2,43,300

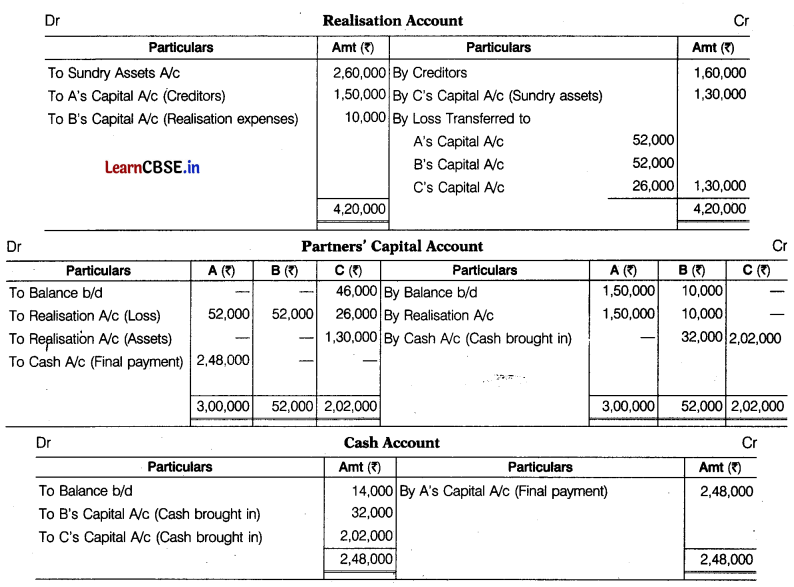

Or

Following is the extract from the balance sheet of Satpal Ltd.

Additional Information

Proposed dividend for the year 2019 ₹ 3,00,000 and 2020 ₹ 3,50,000

Calculate net profit before tax and extraordinary items.

(a) ₹ 3,50,000

(b) ₹ 2,50,000

(c) ₹ 6,00,000

(d) ₹ 6,50,000

Answer:

Question 30.

ABC Ltd is a financial company which provides loan and invest into shares. At the year end, company received ₹ 50,000 interest on loan. Where will be the amount of interest presented? [1]

(a) Activity arising from interest will be shown in investing activity

(b) Activity arising from interest will be shown in financing activity

(c) Activity arising from interest will be shown in operating activity

(d) None of the above

Answer:

(c) The ABC Ltd is engaged in the business of providing loans and also investing in shares. Any income arising from these activities should be shown under operating activity.

![]()

Question 31.

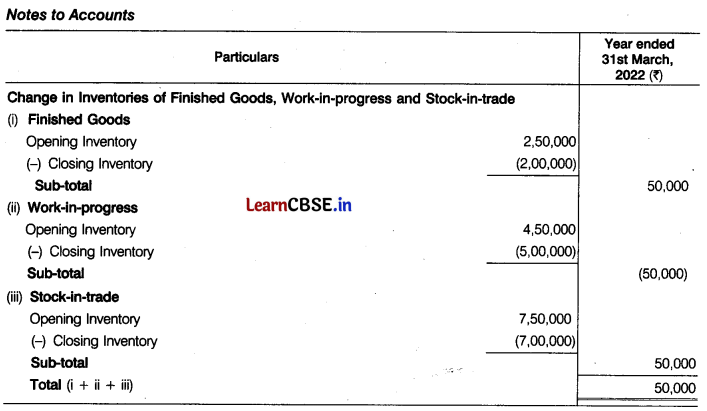

Draw notes to accounts for change in inventories of Vansh Ltd for the year ended 31st March, 2022 from the following information and determine the amount that will be shown in the statement of profit and loss against change in inventories of finished goods, work-in-progress and stock-in-trade. [3]

Answer:

₹ 50,000 will be shown in the statement of profit and loss against change in inventories of finished goods, work-in-progress and stock-in-trade.

Question 32.

(i) How the earning capacity of a business is assessed by financial statement analysis?

(ii) How does subjectivity become a limitation of financial statement analysis?

Answer:

(i) The earning capacity of a business is assessed by financial statement analysis through profitability ratios.

(ii) Subjectivity becomes a limitation of financial statement analysis because an analyst has to exercise his own judgement and bias in the process of drawing conclusions.

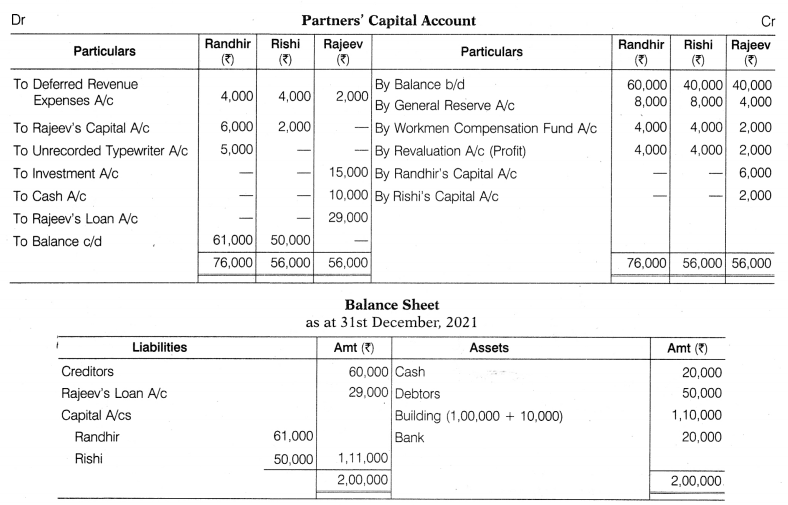

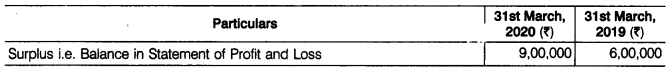

Question 33.

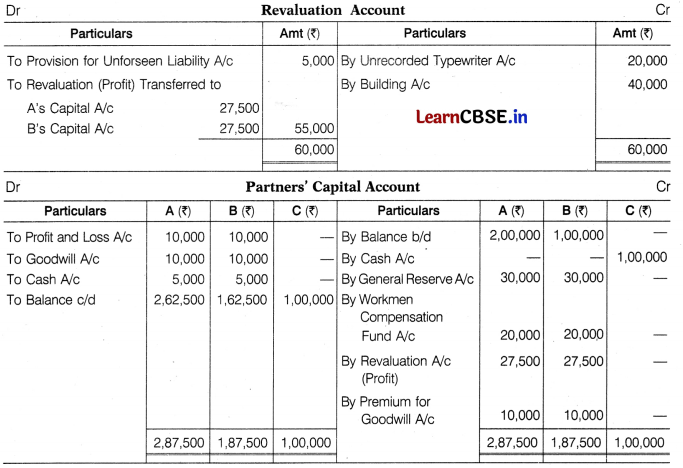

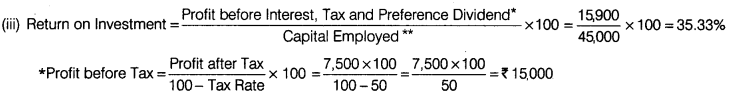

From the following information, calculate any two of the following ratios

(i) Debt-to-equity ratio

(ii) Working capital turnover ratio

(iii) Return on investment

Additional Information

Equity share capital ₹ 25,000, general reserve ₹ 2,500, balance of statement of profit and loss after interest and tax ₹ 7,500, 9% debentures ₹ 10,000, creditors ₹ 7,500, land and building ₹ 32,500, equipments ₹ 7,500, debtors ₹ 7,250, cash ₹ 2,750, revenue from operations, i.e. sales for the year ended 31st March, 2020 was ₹ 50,000, tax rate is 50 %.

Or

Assuming that debt to equity ratio is 2: 1. State giving reasons, whether this ratio will increase or decrease or will have no change in each one of the following cases

(i) Sale of fixed asset (book value ₹ 40,000 ) at a loss of ₹ 5,000.

(ii) Issue of new shares for cash.

(iii) Redemption of debentures for cash.

(iv) Declaration of final dividend.

Answer:

Any two ratios

(i) Debt to Equity Ratio = \(\frac{\text { Debt }^{\star}}{\text { Equity or Shareholders’ Funds }{ }^{\star}}=\frac{10,000}{35,000}\) = 0.286: 1

Debts =9 % Debentures = ₹ 10,000

Shareholders’ Funds = Equity Share Capital + General Reserve + Balance of Statement of Profit and Loss

= 25,000+2,500+7,500 = ₹ 35,000

![]()

(ii) Working Capital Turnover Ratio = \(\frac{\text { Revenue from Operations (Net sales) }}{\text { Working Capital }^{\star}}=\frac{50,000}{2,500}\) = 20 times

Working Capital = Current Assets – Current Liabilities =10,000-7,500=₹ 2,500

Current Assets = Cash + Debtors =2,750+7,250=₹ 10,000

Current Liabilities = Creditors =₹ 7,500

Profit before Interest and Tax =15,000+900 (Interest on Debentures) = ₹ 15,900

**Capital Employed = Equity Share Capital + General Reserve + Balance of Statement of Profit and Loss

=25,000+2,500+7,500+10,000=₹ 45,000 +9% Debentures.

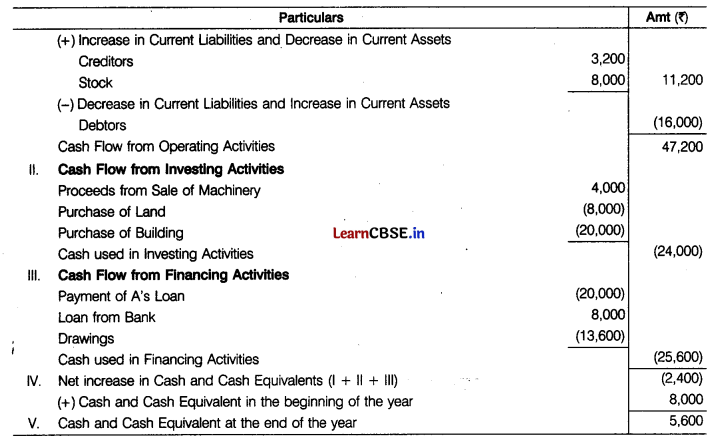

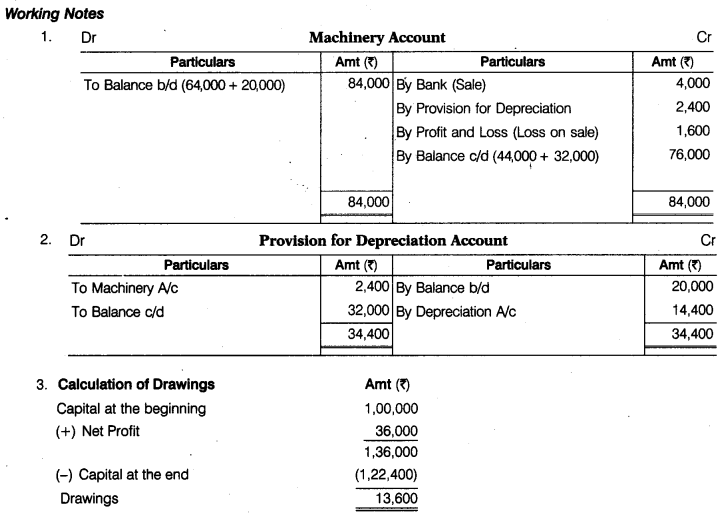

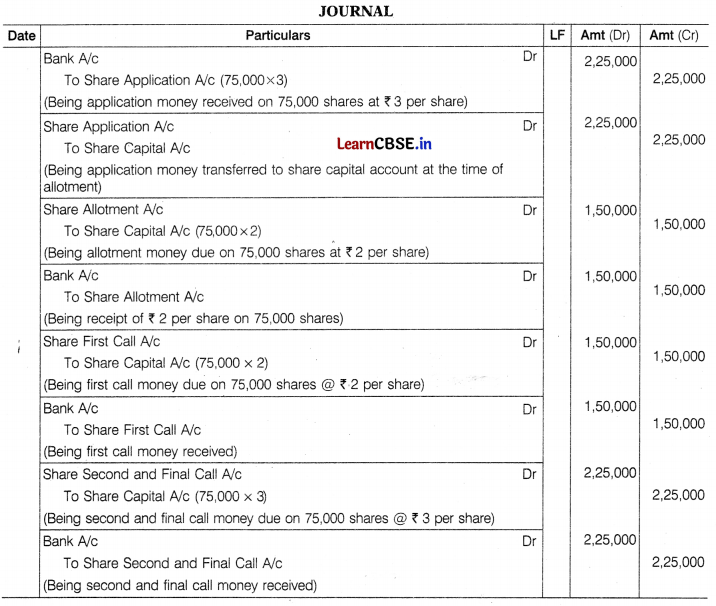

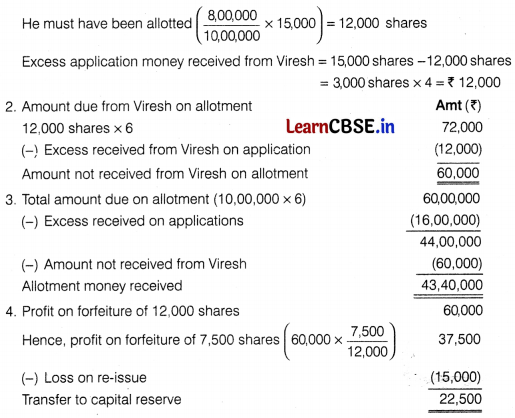

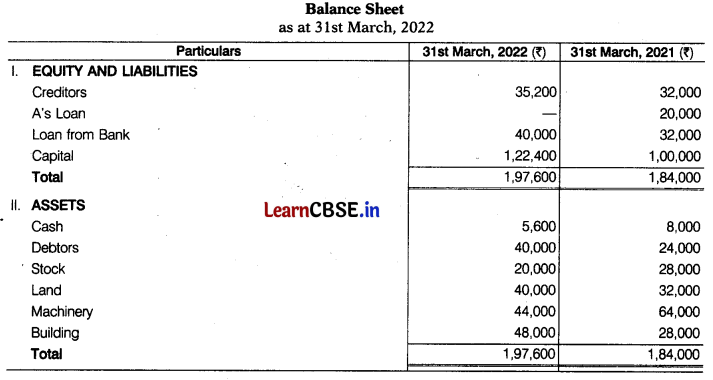

Question 34.

From the balance sheet and information given below, prepare cash flow statement

During the year, machine costing ₹ 8,000 (Accumulated Depreciation ₹ 2,400 ) was sold for ₹ 4,000. The provisions for depreciation against machinery as on 31st March, 2021 and 31st March, 2022 were ₹ 20,000$ and ₹ 32,000 respectively. Net profit for the year amounting to ₹ 36,000.

Answer: